Bitcoin vs. Gold and Hedging the Collapse of the USD

Outro originally recorded for Episode 07 — Pete Karabas: Entrepreneurship, Resilience, Extraterrestrials, Twin Telepathy & Cryptocurrencies, 12/07/21

Pete mentioned bitcoin being the first proven use case for crypto, and talked about it as digital gold. I wanted to dive into this concept further, as it’s a good way to help people new to the crypto space understand the merits of bitcoin. Bitcoin as a replacement for gold is one the best argument I’ve seen for the bull case on bitcoin, in that it serves as a better monetary asset than gold in every metric. Thus, its market cap deserves to be at least ~$10tn, the current market cap of gold. Arriving at that market cap would place the implied value of bitcoin at $476k per coin or about 10x the current price, because to Pete’s point the total number of bitcoins that will ever be produced or “mined” is cryptographically fixed at 21mn.

I highly recommend the white paper Bitcoin for the Open-Minded Skeptic by Matt Huang of Paradigm Capital for anyone who is interested in learning more¹. He lays out the metrics as to what makes something a monetary asset — namely scarcity, portability, fungibility, divisibility, durability and broad acceptance. Bitcoin is better than gold in terms of all of them but one today — broad acceptance. However, even within this metric of “broad acceptance” he argues that gold is fast losing its advantage, which we’ve subsequently seen firsthand as there’s more adoption into bitcoin from institutions like Tesla and SkyBridge Capital.

He further highlights that bitcoin also has additional, non-traditional monetary features such as being digital, programmable, decentralized, censorship-resistant and universal. Of course, its important to mention that there’re of course a number of risks that could stop bitcoin from passing gold, including regulatory restrictions, the risk of another cryptocurrency replacing it, and the “unknown unknowns”.

Now — many crypto bulls would go even further and argue bitcoin also makes for a better store of wealth than the USD. The arguments for and against bitcoin vs. the USD present a much more complicated, longer discussion. However, what is undeniable is that the there are valid concerns about the USD remaining the reserve currency for the foreseeable future.

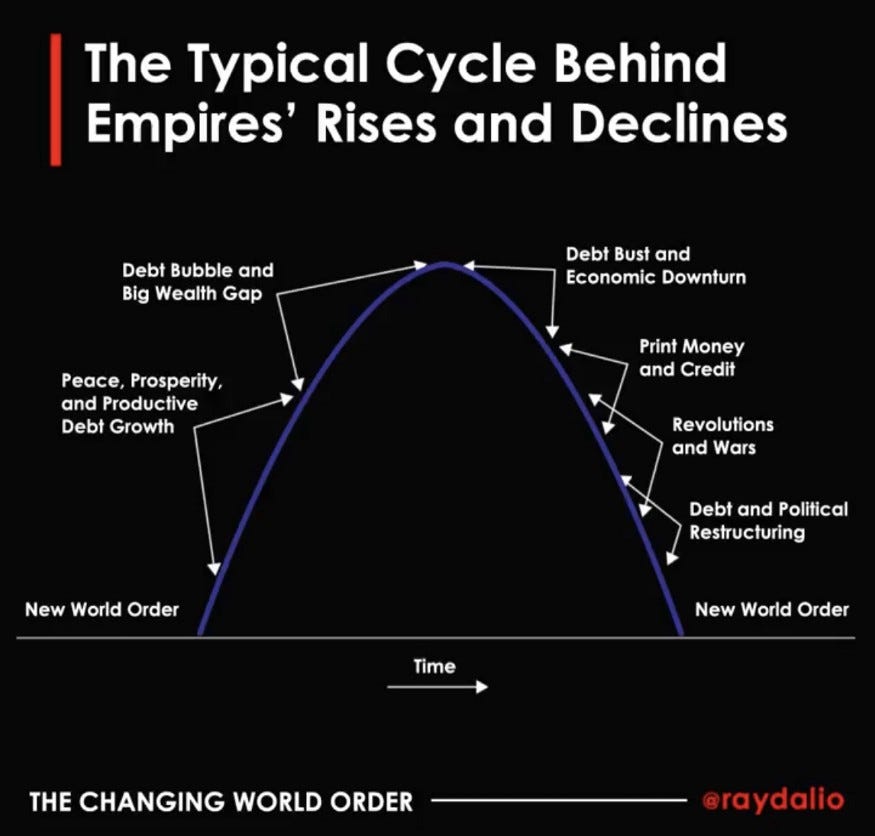

This is based on a number of factors including where the US stands in the long-term debt cycle, the metrics of changing global power status relative to an emerging China, post-pandemic inflationary pressures and how a transition off of fossil fuels could impact the value of the USD given the importance of the petrodollar.

I don’t say any of this to scare anyone, but rather to provide my sense of gratitude that we’ve discovered blockchain technology and decentralized finance. I’m glad that we’re developing viable alternatives to the USD in the black swan event of its collapse, especially as the most likely other fiat currency would be the renminbi, which has its own set of systemic risks.

I hope each of you is encouraged to take the time to understand how cryptocurrencies work. Once we can bring crypto into the modern lexicon and appreciate the opportunity of DeFi, then we can start to innovate the foundations of capitalism itself.

¹ Huang, Matt, on behalf of Paradigm Capital. Bitcoin for the Open-Minded Skeptic. May 2020. https://www.matthuang.com/static/Bitcoin_For_The_Open_Minded_Skeptic.pdf

² Dalio, Ray. Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail. New York: Simon & Schuster, 2021.